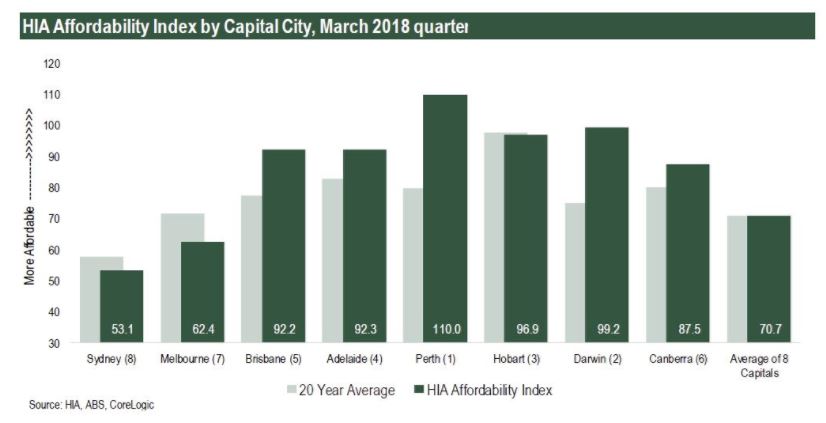

Affordability improved in most Australian capitals during the first quarter of 2018 due to easing house prices, according to the Housing Industry Association’s (HIA) Affordability Index for the March 2018 quarter.

The index is calculated for each of the eight capitals and regional areas on a quarterly basis and takes into account the latest dwelling prices, mortgage interest rates, and wage developments. The results are then published and analysed in the HIA Affordability Report.

“Affordability in Sydney improved by 1.9 per cent as a result of the reduction in dwelling prices over the past six months, while in Melbourne the outcome was largely unchanged as price growth remains solid,” said Shane Garrett, senior economist at HIA. “Across the eight capital cities overall, affordability improved slightly (+0.2 per cent) during the March 2018 quarter. The improvement was held back by strong home price growth in a limited number of markets, including Melbourne and Hobart.”

Garrett added that current interest rate settings facilitate affordability. “The RBA’s official cash rate is at a record low and hasn’t been moved in over 20 months – an unprecedented period of stability,” he said.

Nevertheless, housing affordability remains challenging in the larger capitals—and the root cause of the problem is that the cost of producing new houses and apartments is still too high.

“Governments need to focus on solutions involving lower land costs, a more nimble planning system and a lighter taxation burden on new home building,” Garrett said.

Also read: What are the merits of solving Australia’s housing affordability crisis?

Collections: Mortgage News

Share