.jpg)

It appears that the changes in mortgage serviceability rules and lower home-loan interest rates have started to drive demand back to the housing market, with the auction market reporting robust clearance rates.

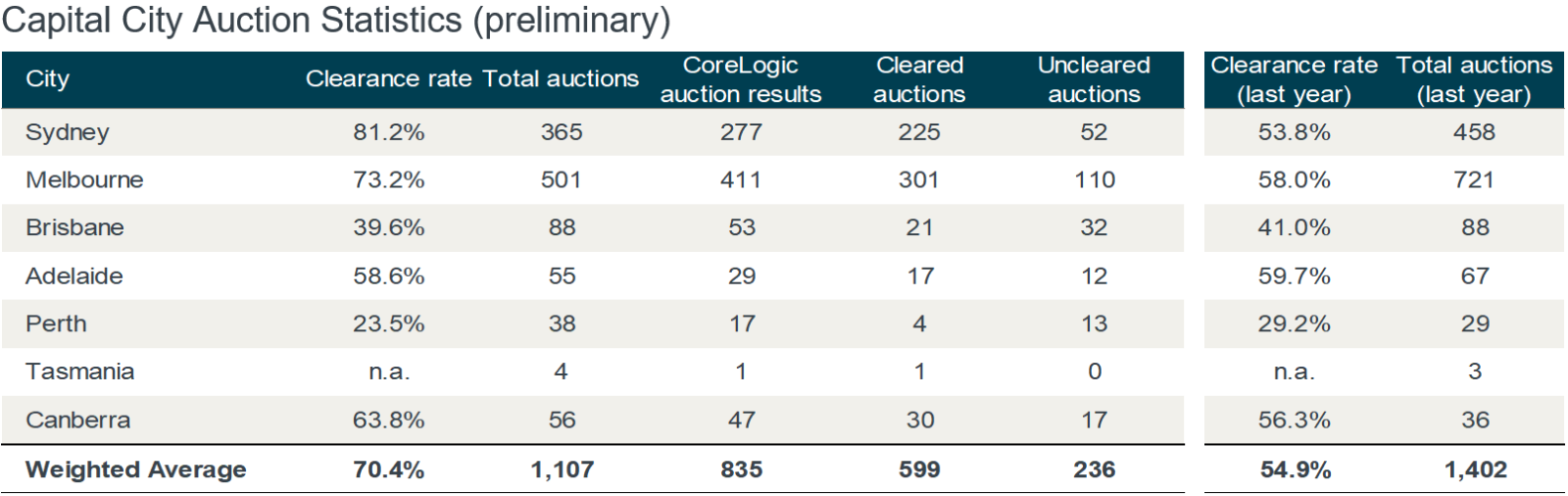

There were 1,107 capital-city homes taken to auction this week, returning a preliminary auction rate of 70.4%, up from last week's 68.3%, according to latest auction report by CoreLogic.

The strengthening weighted average results of late could be mostly attributed to Melbourne and Sydney, both of which have consistently reported clearances rates above 70% over the past few weeks.

Sydney shone the brightest this week as it recorded a clearance rate of 81.2%. In terms of auction volumes, Melbourne took the top spot with 501 homes taken to auction.

"The consistent trend where final clearance rates hold above the 70% mark implies the market is responding to the stimulus of lower mortgage rates, improved sentiment following the federal election and lower serviceability tests for borrowers, as well as low advertised stock levels," said Jade Harling, analyst at CoreLogic.

The table below shows the performance of each capital city:

Collections: Mortgage News

Share