.png?language_id=1)

Whether you’re a homebuyer or an investor, it can be difficult to know where to start looking in Australia’s robust residential property market. Australia is home to all types of properties, some with their own terminology and characteristics.

Free-standing houses

Free-standing houses are the most common and generally the most sought-after type of home in Australia. The Australian Bureau of Statistics (ABS) defines a free-standing house as that which is separated from other dwellings by a space of at least half a metre. A house on its own block of land has long been the mainstay of ‘the Great Australian Dream’ of home ownership. At the last census in 2021, separate houses made up just over 70% of Australia’s housing stock.

However, the most recent census data shows a slip in the proportion of houses in Australia’s greater capital cities in the five years since the previous census - down from 66% of housing to 64.8%. This was largely due to a jump in high density homes added in those areas during that time.

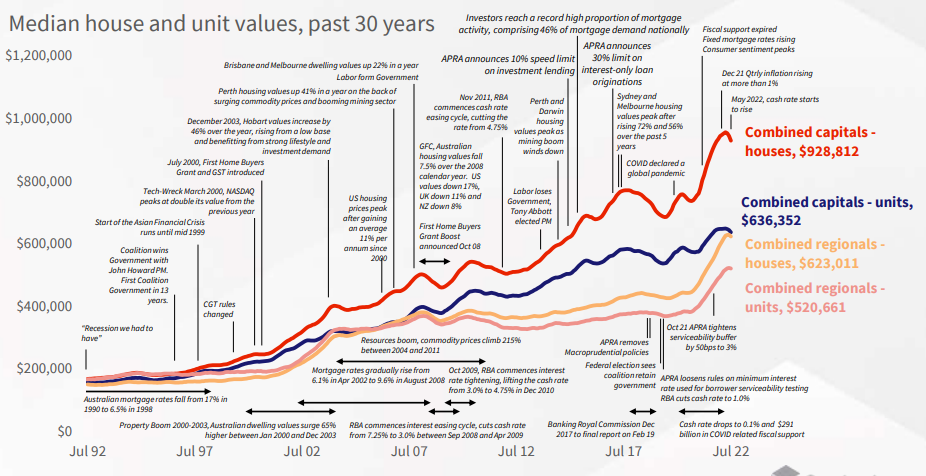

Many homebuyers consider free-standing houses as providing more space for themselves, their families, and their pets. Historically, houses have also appreciated far more in value than apartments over the long term, driven largely by their underlying land value. In the 30 years to 2022, house values rose 453% compared to units at 370%, as illustrated below:

Source: CoreLogic

In recent times, however, with Australia facing a housing shortage and many buyers priced out of purchasing a standalone house, property market analysts are tipping unit values to rise faster than houses in the medium term, driven largely by demand for affordable housing. In the four years since the pandemic to January 2024, the price difference between houses and apartments had increased by a record 45%.

Granny flat

Granny flats are a secondary, usually smaller, dwelling that’s typically located on the same block as a standalone house. They are largely self-contained, but not always, and can be attached to the main dwelling or built as a separate structure. In previous times, granny flats were designed to accommodate older family members but more recently, granny flats can be added as source of rental income, as home offices, or additional living space.

Granny flats are not sold separately because they are on the same title as the main home. Relaxed planning laws in many local government areas have driven a substantial rise in the number of granny flats in Australia in recent years. The 2021 census revealed the number of granny flats rose more than 400% over the previous five years. In 2023, a report identified more than 660,000 sites in Australia’s three largest cities - Sydney, Melbourne, and Brisbane - that could accommodate granny flats. Some estimates indicate granny flats can add up to 30% to the value of a property and can provide a steady income stream if the flat is rented out.

Duplexes or semi-detached homes

Duplexes, as their name implies, indicate there are two dwellings to a block although they have separate titles, setting them apart from dual occupancy houses with granny flats. Duplexes are generally joined by a common wall or can sometimes be separate upstairs/downstairs dwellings. Some duplexes may even be detached but still share the same plot of land.

Duplexes became more popular in Australia in the 1990s and 2000s, particularly in more densely populated or sought-after areas. Duplexes usually have a strata title which means each owner has individual ownership of their own duplex as well as shared ownership of common areas. This may be a driveway or garden, for example. Duplexes are considered a type of medium density housing in Australia.

Townhouses

Townhouses are generally attached homes that can be built in a row or cluster, commonly with each home having its own private entrance and backyard or courtyard. They are often built as multilevel dwellings to maximise space, commonly with shared walls. Some townhouse complexes may also offer shared amenities such as outdoor recreation space, barbecue areas, swimming pools, or gymnasiums.

Terrace houses are similar to townhouses in that they are built in rows and each home has its own private entrance and backyard. Terrace houses are older than the modern townhouse developments and more common in older, inner city areas of Sydney and Melbourne.

Unit or apartment

Units, or apartments, are generally interchangeable terms in Australia. They are a popular choice of housing for people living in inner-city and other populated areas. In the majority of cases, units are within a building with multiple dwellings and are generally self-contained, although may share some facilities with other units such as an entrance, stairwell, or garage. Some may also share pools, gyms, and outdoor areas while older units may even involve a shared laundry or other amenities.

Units are considered high density dwellings and have been steadily growing as a proportion of the country’s housing stock. As at the 2021 census, units made up 11% of Australia’s dwellings but accounted for more than 15% in the greater capital cities - up from 12.6% in 2016. Together, high and medium density dwellings made up more than 35% of Australia’s capital city housing stock.

Units and apartments in Australia are subject to strata property by-laws that can differ from property to property. These are created and enforced by the owners of the building, commonly known as the ‘body corporate’, and are intended to meet the needs of everyone living in the complex to create a safe and harmonious living environment. These by-laws may cover:

- managing noise levels

- keeping pets

- hanging washing on balconies

- installing hard flooring

- smoking

- use of a balcony barbecue

- moving in/out time restrictions

- installing particular curtains or blinds

Units have generally served as a more affordable option for first homebuyers and investors seeking rental yields. Over the past decade, units accounted for around 42% of new housing completions nationally but in recent years, high and medium density completions have plunged, dropping more than 25% in the year to December 2023, according to ABS data. This has largely been driven by ongoing building supply issues, labour shortages, the cost of finance, and cost blowouts in the construction sector.

Over 55s housing

These multiunit dwellings are generally purpose built within communities designed for retirees and older Australians. They are typically developed by private operators who continue to manage the facility with the dwellings generally being sold on a leasehold basis.

Buying into a retirement community is not the same as buying a private home. Over 55s dwellings may not reflect property values on the private market and each community comes with its own terms and conditions, ongoing fees, and exit charges. Often the communities feature shared amenities and may provide some in-house support services for older residents. Over 55s, or independent living, communities should not be confused with aged care facilities which provide higher levels of care for those who can no longer live independently.

The table below features some of the lowest home loan rates on the market.

| Lender | Home Loan | Interest Rate | Comparison Rate* | Monthly Repayment | Repayment type | Rate Type | Offset | Redraw | Ongoing Fees | Upfront Fees | Max LVR | Lump Sum Repayment | Additional Repayments | Split Loan Option | Tags | Row Tags | Features | Link | Compare | Promoted Product | Disclosure |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

5.79% p.a. | 5.83% p.a. | $2,931 | Principal & Interest | Variable | $0 | $530 | 90% |

| Promoted | Disclosure | |||||||||||

5.84% p.a. | 5.86% p.a. | $2,947 | Principal & Interest | Variable | $0 | $250 | 60% |

| Promoted | Disclosure | |||||||||||

5.74% p.a. | 5.65% p.a. | $2,915 | Principal & Interest | Variable | $0 | $0 | 80% |

| Disclosure | ||||||||||||

5.89% p.a. | 6.13% p.a. | $2,962 | Principal & Interest | Variable | $250 | $250 | 80% | Disclosure | |||||||||||||

5.88% p.a. | 6.01% p.a. | $2,959 | Principal & Interest | Variable | $10 | $450 | 80% | ||||||||||||||

5.93% p.a. | 5.96% p.a. | $2,975 | Principal & Interest | Variable | $0 | $845 | 80% | ||||||||||||||

5.94% p.a. | 6.00% p.a. | $2,978 | Principal & Interest | Variable | $0 | $835 | 70% | ||||||||||||||

6.04% p.a. | 6.26% p.a. | $3,011 | Principal & Interest | Variable | $15 | $784 | 80% | ||||||||||||||

5.89% p.a. | 6.18% p.a. | $2,962 | Principal & Interest | Variable | $299 | $350 | 80% | ||||||||||||||

6.24% p.a. | 6.27% p.a. | $3,075 | Principal & Interest | Variable | $0 | $null | 90% | ||||||||||||||

6.29% p.a. | 6.30% p.a. | $3,092 | Principal & Interest | Variable | $null | $null | 80% | ||||||||||||||

6.54% p.a. | 6.63% p.a. | $3,174 | Principal & Interest | Variable | $8 | $350 | 70% | ||||||||||||||

6.99% p.a. | 6.99% p.a. | $3,323 | Principal & Interest | Variable | $0 | $160 | 95% | ||||||||||||||

8.55% p.a. | 8.69% p.a. | $3,862 | Principal & Interest | Variable | $8 | $600 | 95% | ||||||||||||||

5.79% p.a. | 5.80% p.a. | $2,931 | Principal & Interest | Variable | $0 | $750 | 70% | ||||||||||||||

5.74% p.a. | 6.19% p.a. | $2,915 | Principal & Interest | Variable | $0 | $530 | 90% |

| Disclosure |

Photo by Bailey Rytenskild on Unsplash

Share